Mova Credit Card Customer Segmentation is a data analysis and planning tool:

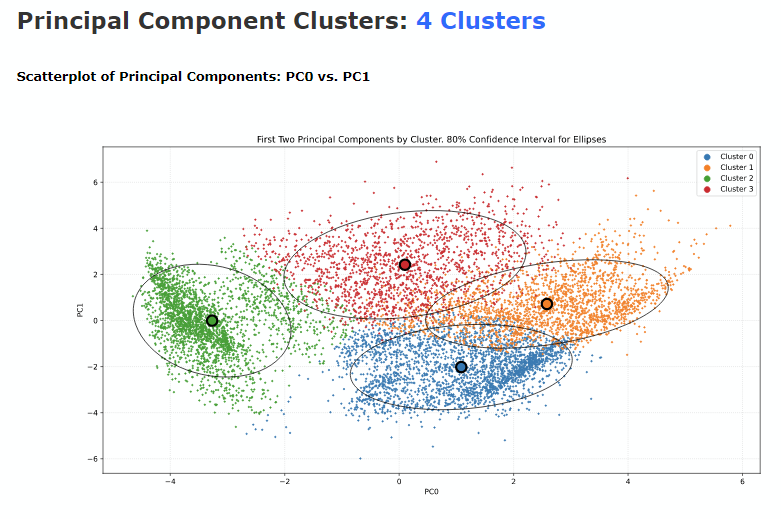

- Successful segmentation clusters customer data into groups that have the same traits or characteristics.

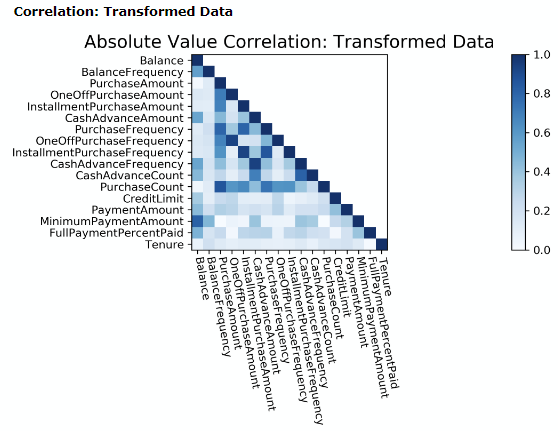

- Gain a better understanding of customers’ needs and wants.

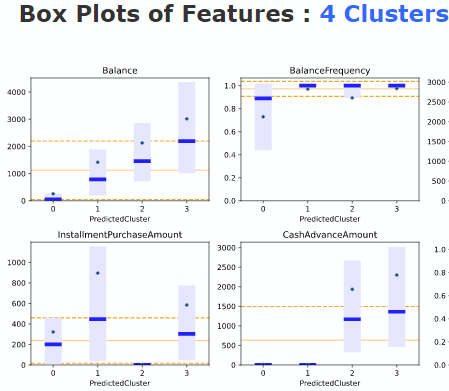

- Use segmentation to improve business competitiveness, plan effective marketing, and grow revenues.