Consumer Finance Analyzer is a data analysis tool for business and marketing people in consumer finance:

- It displays a consolidated graphical view of the U.S. Federal Reserve (central bank of the United States) Survey of Consumer Finances.

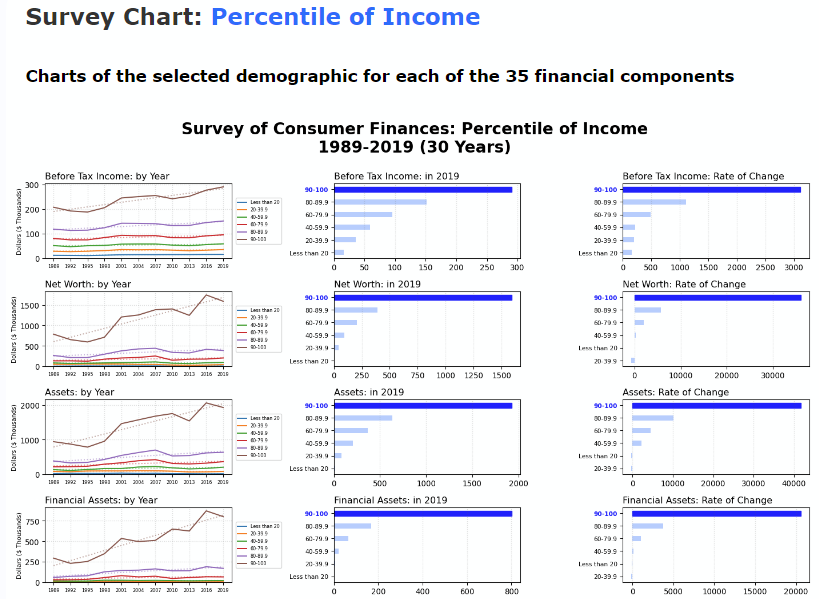

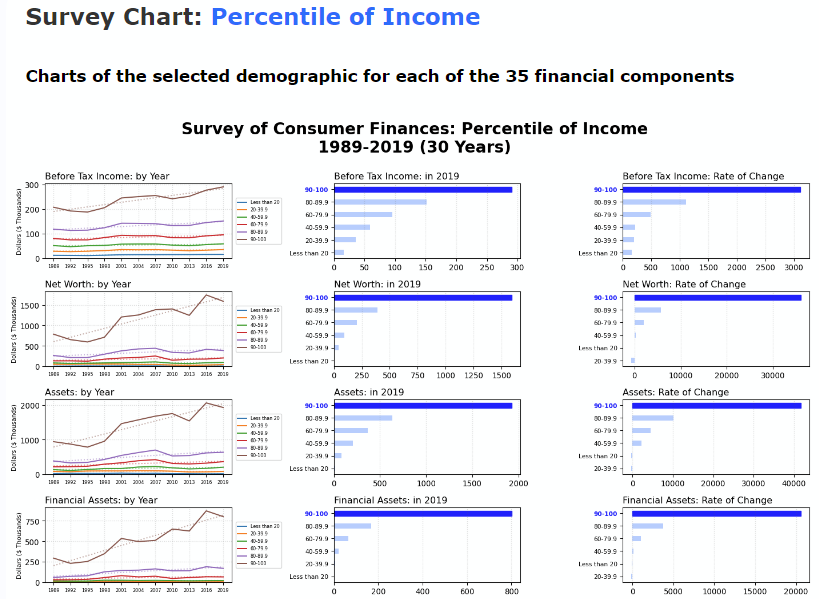

- The time series charts show the trends of each demographic category for all the financial components.

- The charts of current amount shows the largest demographic category for each financial component.

- The charts of rate of change shows the ranking of demographic category growth for each financial component.

- Gain a better understand of the U.S. household market demographics and use of financial products.

- Use the output for business planning and market development.

Run Mova Consumer Finance Analyzer

Run Mova Consumer Finance Analyzer again.

Select the Demographic and the Date Period from the lists below:

Each demographic has a different financial performance. A longer Date Period shows the longer pattern. The trend line smoothes out variations and cycles. A shorter Date Period ignores older periods that might not be relevant now. The trend line captures the more recent direction.

It’s easy. It’s free. No signup or registration. The app takes ten (10) seconds to run. Please be patient.

Why analyze the FED Survey of Consumer Finances?

- The markets and needs for financial services are changing fast. The new generation wants simplicity, ease of use, trust and personalization.

- Traditional financial services companies, such as banks and insurance, are saddled with legacy systems, outdated products and inflexible processes.

- Modern financial technology companies are offering new products and services, especially in payments and lending, that appeal to today’s consumers.

- Fintech companies are innovating and creating new services in areas such as open banking, omni-channel banking, and robo-advisors.

- All of them need to accurately understand consumers and their finances.

- Market data is available, but often not presented clearly in order to see trends and opportunities.

- The FED Survey of Consumer Finances tracks the wealth of American families. Demographic information is factual and statistical, which is more reliable than qualitative data such as personal preferences or opinions.

Use Consumer Finance Analyzer for:

- Marketing effectiveness: Identify the demographics and demographic categories that show the most market potential. Gain insights into the demographic categories. Test new product development and pricing.

- Marketing efficiency: Each demographic category has a different value to the company. Allocate marketing and sales resources to each category according to its value and customers’ response.

- Combination segments: Combine the demographic categories from the analysis with other segmentation descriptors such as psychographics, geographics and behavior.

How Mova Consumer Finance Analyzer works

- This application uses data from the Federal Reserve Survey of Consumer Finances, which is a survey of 6,000 U.S. families every three years. The dataset covers surveys for 30 years from 1989 to 2019 (the most recent survey available). There are eight demographics, such as income and age. There are 35 financial components, such as assets and debts.

- You select the demographic. You select the date period.

- The application iterates through the 35 financial components and displays three charts for each one.

- The first chart shows the time series of the financial component for the Date Period you selected.

- The second chart shows the amount value of the financial component at 2019, the last year of the survey.

- The third chart shows the rate of change of the financial component for the Date Period.

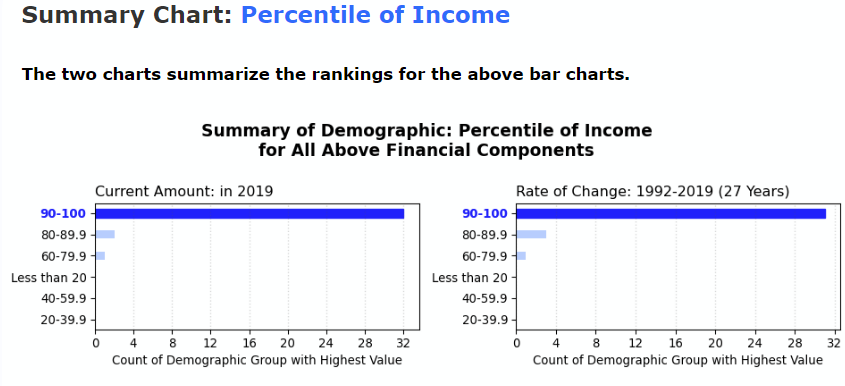

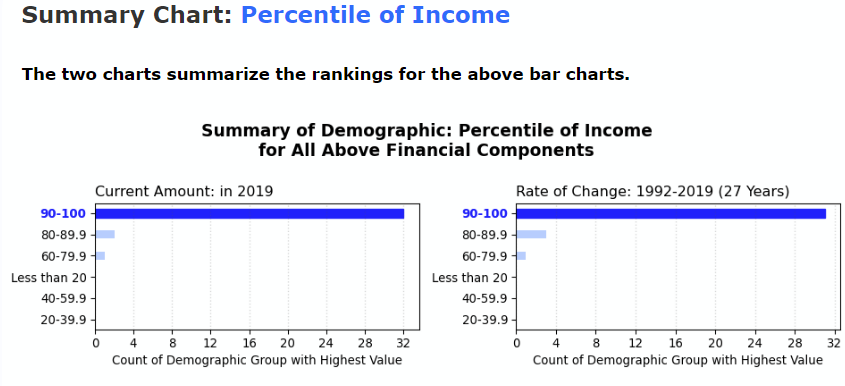

- Two summary charts show for all the above charts the leading demographic categories for the 2019 amount and the rate of change for the date period.

Use Consumer Finance Analyzer for:

- Your ideal customer of financial services will be defined by their demographic categories, and other market segment descriptors.

- The more you know about your target market, the higher the chances your marketing messages will resonate with the audience.

- Learn what demographic groups are leading or changing in each financial component.

- You can customize and personalize your marketing campaigns for each target segment. This should attract higher quality leads.

- With a more specific value proposition and message, you can differentiate your brand from competitors in each segment.

Mova Consumer Finance Analyzer: Sample Report

Sample output report from Mova Consumer Finance Analyzer